Wouldn't this advice be helpful every Friday?

Sign up to receive Tom Brown's Exclusive Banking Weekly in your Inbox each Friday.

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

–Copyrighted Material; Do Not Forward, Photocopy, or Redistribute In Any Way–

Vol. VII, No. 13

TOM BROWN’S BANKING WEEKLY: 4/8/22

Financial Services Insights and Intelligence

FIRST WORD: Closing the customer experience gaps. In the 1990s, Joe Guyaux, who ran PNC’s retail banking business at the time, opened my eyes to “customer experience gaps.” He showed me data covering many areas of the company’s retail business where customers’ view of their experience was wildly below the company’s internal measurement of how good it was. Until that point, I relied on company-supplied measurements of their performance, but Guyaux showed that that was insufficient. Hence, I began my own channel checks and sought out alternative data from consultants and polling firms. The customer experience gaps still exist, and what is disappointing is how little progress most banking companies have made in closing such gaps.

From my perspective, the primary reason why the gaps persist is that most banks still don’t have a single view of their multi-product customers because they haven’t been able to connect all the separate product silos. One reason Bank of America’s Erica, the company’s AI-powered bot, was so impressive when it was first launched was that BofA had to bust its silos to make it work. This still can’t be done at JPMorgan, but that should change after the company moves its core consumer processing to Thought Machine over the next few years. The second reason for the gaps is that measuring how the client views his experience is tougher and more expensive than determining a company’s internal measure. I have always been very impressed with Schwab CEO Walt Bettinger’s mantra for the company, “Through the client’s eyes.” It is not good enough to know how well a company is doing relative to its own standards; it needs to know how well it’s doing relative to the customer’s standards.

A recent Redpoint Global and Harris survey contained some interesting data on customer experience gaps.

- 51% of marketers believe they are delivering “exceptional” customer service compared to just 26% of customers. The bad news is that is a wide gap; the good news is that the last time these firms did this survey, in 2019, the gap was 30 points.

- The researchers found customer experience gaps of 24 points in understanding the customer, 21 points in personalization, 21 points in consistency at delivering across all channels, and 17points in providing privacy.

- Compared with other industries, banking and retailing were ranked highest among all industries where customers expect exceptional service, but only 25% of consumers surveyed said those industries deliver exceptional service.

- Banking customers have high expectations: 82% expect banks to personally understand them, while just 38% believe their bank does. (Note to my friends at Personetics!)

- Customers expect banks to have seamless, relevant, and timely communications across all channels, yet only 45% say that is what they experience.

For decades, banks have overestimated how well they are serving their customers. But the good news is that as each bank travels along its own digital revolution highway, it will gain more tools such as improved data management, the use of machine learning, and AI to develop a unified customer view it can use to close those customer experience gaps. As an analyst and an investor, I would appreciate more companies disclosing their internal views of where those gaps exist today and provide updates as they make progress in closing them.

BY THE NUMBERS: Happy earnings season! The consensus looks for S&P 500 companies to report first-quarter earnings growth of 4.7%, on average, which would be the slowest growth since the fourth quarter of 2020. The financials in particular are set to show an earnings decline of 24.2%, the weakest results of the eleven S&P 500 industry sectors.

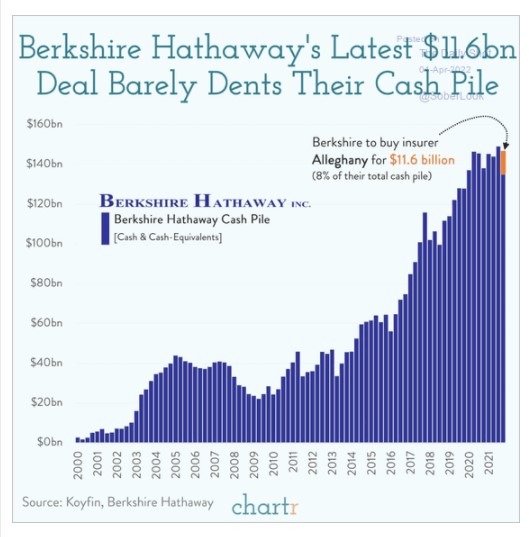

THE DEFINITION OF “SITTING ON A CASH PILE”?: When you announce an $11.6 billion cash acquisition and it barely makes a dent in the total cash holdings.

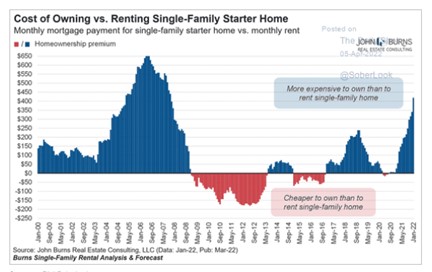

RE-INFLATING?: Another sign, maybe, that the ongoing surge in home prices is on the verge of becoming insane. Relative to renting, the homeownership premium hasn’t been this high since the mid-2000s housing bubble was in full swing.

AT LAST: Now even the doves are getting nervous:

Federal Reserve Governor Lael Brainard, who normally favors loose policy and low rates, said Tuesday that the central bank needs to act quickly and aggressively to drive down inflation.

In a speech for a Minneapolis Fed discussion, Brainard said that policy tightening will include a speedy reduction in the balance sheet and a steady pace of interest rate increases. Her comments indicated that rate moves could be higher than the traditional 0.25 percentage point moves. [Emphasis added.]

Nearly reassuring! Except that the Fed now has to play catch-up on tightening so furiously that it’s hard to see how it will get inflation under control without also tipping the economy into recession.

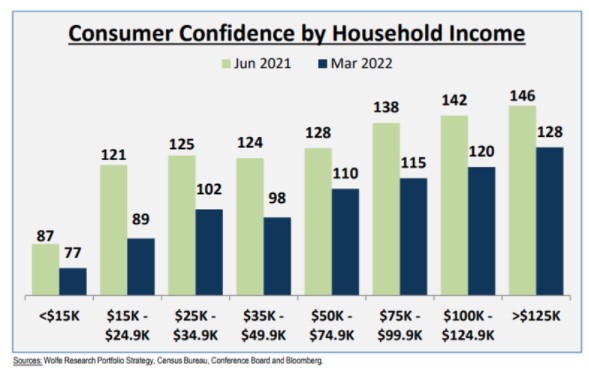

DECLINING CONSUMER CONFIDENCE: The old adage that inflation is the cruelest tax since it disproportionately hurts the poor might account for such a large decline in confidence among those making $50,000 or less.

A BIG SUPPLY CHAIN PROBLEM: While the waits at the ports continue to decline, indicating some easing in the supply chain, it’s too late for the Georgia Peach ice cream sandwich, traditionally a staple offering for Masters attendees. The sandwich won’t be available this year. Other items such as the sausage biscuit and a beer will cost more, but still at unusually low prices.

A BIG SUPPLY CHAIN PROBLEM: While the waits at the ports continue to decline, indicating some easing in the supply chain, it’s too late for the Georgia Peach ice cream sandwich, traditionally a staple offering for Masters attendees. The sandwich won’t be available this year. Other items such as the sausage biscuit and a beer will cost more, but still at unusually low prices.

TRANSPARENCY UPGRADE: Well good for Zions Bancorp. The company disclosed last Friday that it will break out what it spends on technology, telecom, and information processing as a separate line item on its P&L, rather than continue to lump those costs in with “furniture, equipment, and software.” As I say, a good move. Inasmuch as the level and quality of a bank’s IT spending will likely turn out to be a key differentiator whether it wins or loses in the marketplace going forward, this is a very meaningful improvement in disclosure that will be a big help to investors. More banks should move to be more specific on what they’re spending on technology using some commonly agreed-upon definition.

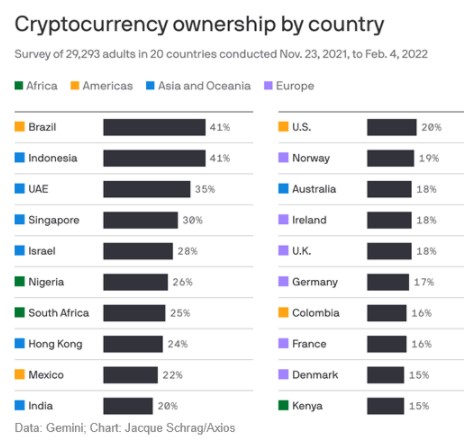

IS CRYPTO MAINSTREAM: Many observers have said, and I agree, that 2021 was the year that cryptocurrencies went mainstream. Gemini reports that 41% of all crypto holders bought cryptos for the first time last year.

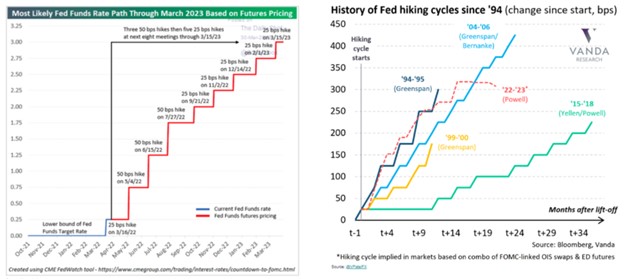

SAME MOVIES, DIFFERENT ACTORS, AND IT’S SHORTER: Fed funds futures this week implied that over the next year the Fed will raise the fed funds rate by 50 basis points at the next three meetings and by 25 basis points over the following five. The Fed followed a similar script in 1994. However, the balance sheets of banks today are completely different than they were back then. The 1994 fed funds rate increases put downward pressure on the net interest margins of most banks, while today the rate rise should put upward pressure on margins. In addition, in 1994 many banks, such as First Bank System, were not used to limiting the tangible book value exposed from rising bond yields, unlike today. Bank stocks rose 50% in 1995 when the rate pressure was over. I expect bank stock prices will benefit sooner rather than later when investors discover the differences in this movie remake.

WORD OF THE WEEK: DANDER: “Don’t get your dander up” means “Don’t get mad,” but what is “dander,” anyway? When a dog or a cat is angry, the hair on their back stands straight up. So, too, by analogy, will a person’s, if he’s mad enough, and even his dandruff will stand up, too—for “dander” is merely dandruff.

MYOPIA WATCH: These people are geniuses, I tell you:

STOCK PICKERS JUST SUFFERED THEIR

WORST MONTH IN 20 YEARSThe renewed selloff in equities is offering bears a moment of vindication. But for professional stock pickers, the past month brought a reminder that being too defensive can be costly.

The two-month stock rout at the start of the year sent actively managed funds pouring into cash and loading up on bearish wagers. The moves turned sour during the frenetic rally in the second half of March. As a result, long-only mutual funds trailed their benchmarks on average by a full percentage point last month—the worst performance since 2002, data compiled by Bank of America Corp. show. [Emphasis added.]

I mean, what ever happened to “buy low, sell high”? You’d think that these folks would realize at some point that trying to time the market is a loser’s game. But no.

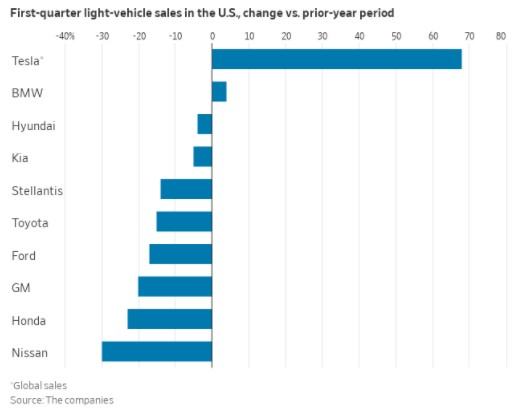

CHANGING MIX OF CAR SALES: The significant increase in the price of gas over the last 15 months and supply chain problems for automobile manufacturers resulted in a large mix shift of U.S. new vehicle sales in the first quarter.

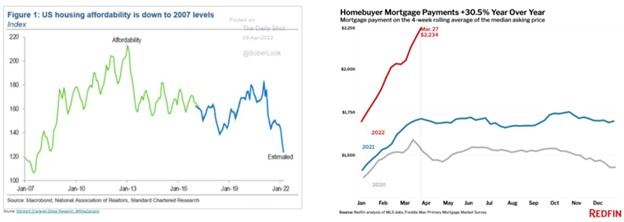

A BIG CHANGE COMING IN HOUSING: As home prices and mortgage rates rise, affordability is the lowest it’s been in 14 years:

However, while this portends a sharp slowing in home sales, the impact on new building and the economy should not compare to what happened after the housing bust in 2007 since there’s no inventory problem this time.

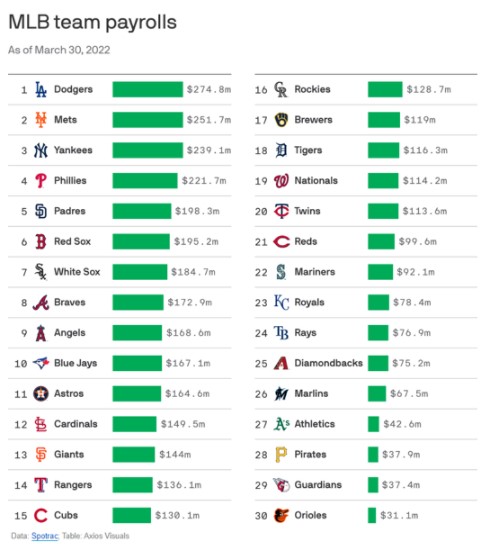

THE UNUSUAL PAY PRACTICES OF MAJOR LEAGUE BASEBALL: Each major professional sports league has a collective bargaining agreement between the owners and the players union which governs the pay practices of their teams. Most have some form of salary cap, and some have minimum payroll requirements. MLB has a salary cap that can be avoided by paying a “luxury tax,” but it has no minimum payroll requirement. With Opening Day rosters set this week, the payroll of each team’s 26-man roster became known, and the range between the highest (the Dodgers, at $275 million) and the lowest (Orioles, $33 million) is staggering. The highest paid individual player this year, the Mets’ Max Scherzer, who’ll earn $43.3 million, will individually make more money than all the players on four teams.

WILL THIS BE THE SUMMER OF “REVENGE TRAVEL”?: “People are saying, ‘Let’s pull the trigger and travel for real this time,’” according to Brian Kelly the CEO of a travel advocacy website, Points Guy. He says travelers are looking to upgrade when they fly, stay in luxury accommodations, and stay longer. (Are you credit card managers reading this getting excited?) Here are some survey results:

- 85% expect to take two weeks or more off.

- Expedia’s CEO predicts this summer will be “the busiest travel season ever.”

- Domestically the most popular destinations are New York, Las Vegas, and Orlando. Outside the U.S., London, Paris, and Cancun are leading the way.

BAD YEAR FOR BILLIONAIRES: According to Robinhood Snacks, there are 329 fewer billionaires than there were last year because of the impact of the sanctions on the Russian oligarchs. This is the biggest decline in billionaires since 2009.

AUTO BUYERS LIKE AN OMNICHANNEL EXPERIENCE: While some consumers like the convenience of online car shopping and build-to-order options, the majority still want to visit a car dealership as part of their car-buying experience. Chase Auto did a consumer survey that found 77% of adults who drove a car want to visit a dealership even if they like to start the car buying process online. In addition, 57% still want to talk with a salesperson, and 85% want to pick up their purchase at a dealership. The car buying experience is changing but has become an omnichannel world.

READY TO GO OVERBOARD: Now here’s something to look forward to. Former New York Fed president Bill Dudley explains why this round of tightening might have to be pretty extreme to do much to cool things down.

In contrast to many other countries, the U.S. economy doesn’t respond directly to the level of short-term interest rates. Most home borrowers aren’t affected, because they have long-term, fixed-rate mortgages. And, again in contrast to many other countries, many U.S. households do hold a significant amount of their wealth in equities. As a result, they’re sensitive to financial conditions: Equity prices influence how wealthy they feel, and how willing they are to spend rather than save. [Emphasis added.]

As a result, for Fed tightening to affect people’s behavior, “it’ll have to inflict more losses on stock and bond investors than it has so far.” Great. Just great.

PAYING ATHLETES FOR GOOD GRADES: A rule the NCAA adopted in 2020 permits FBS schools to pay athletes up to $5,980 each year for getting good grades. ESPN contacted the 130 FBS schools to inquire about their plans and 101 responded.

- 22 plan to pay athletes this year

- 34 are undecided.

- 20 plan to make payments in the future.

- 15 have no plans.

- 10 responded with “no relevant documents.”

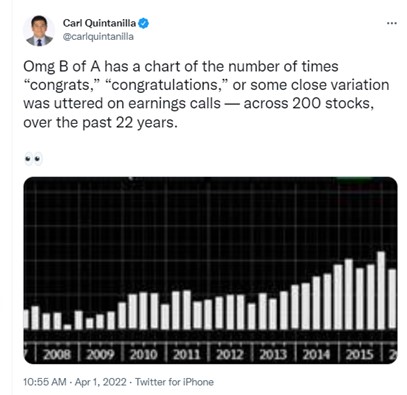

NEW KUDOS: Hang on. What ever happened to “Nice quarter, guys”?

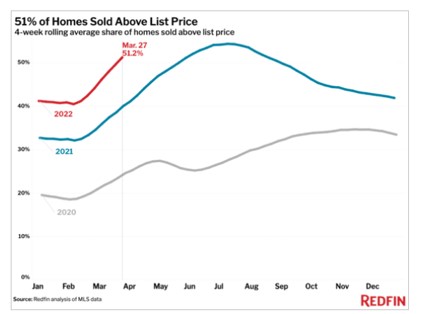

OUT OF WHACK: I have no idea what this really means, but it must mean something: over half of home sales lately are going for more than listing prices. You can point to a wave of panicked buyers for this if you’d like, but those listing prices were essentially set by real estate brokers, who do this for a living full time, remember, and who presumably understand their markets pretty thoroughly. Except that now, they don’t seem to. It’s as if the entire housing market—buyers, sellers, and Realtors—have lost touch with reality entirely and now have no clue how things should be working.

It’s hard to imagine how this will end well, by the way.

RUSSIAN DEBT TIGHTROPE: In 1998, Russia defaulted on some of its debt obligations. I was working at Tiger Management at the time and the firm took a huge loss. A similar situation seems to be developing now. This past Monday, the U.S. blocked Russia from using U.S. banks to channel payments on its dollar-denominated bonds on the same day that a $649 billion payment was due. Prior to Monday, the U.S. had been allowing Russia to tap those reserves if the funds were being used to pay U.S. holders on Russian sovereign debt. Those reserves were frozen otherwise.

Apparently, the Monday payment was made in rubles after U.S. banks wouldn’t process the payments in dollars. The bonds require payments in dollars, but there is a 30-day grace period during which Russia can still make good on its payments. By Wednesday the cost of a Russian credit default swap had risen to 75% of the total value of the debt insured, according to ICE Data Services. This compares to 40% at the beginning of March and 5% at the beginning of February. Russia’s next payment is due May 27, but on May 25, a special Treasury license expires which currently allow U.S. bond holders to receive interest payments from Russia. The Treasury may or may not extend the license.

At this point, it looks like Russia has three options:

- Effectively default but claim they “tried” to pay with rubles.

- Find a third party to make the payments in dollars on its behalf.

- Bite the bullet and use available dollars in non-U.S. locations.

Stay tuned.

THE CONTINUED EVOLUTION OF CURO: Years back when I first was introduced to Curo Financial Technologies, it was largely a branch-based, deep subprime consumer lender. Don Gayhardt has been its CEO for the last ten years, and he has led a significant transformation of the company over the last five. I recently talked with Gayhardt about the company’s current mix of business, but the prime focus of our chat was the company’s two significant acquisitions made in the last year: Flexiti and Heights Finance. Today Curo consists of four parts:

- U.S. direct lending is the old core business. Today Curo operates in 27 states with branches in 13. Heights Finance is included in this unit.

- Canada direct lending.Curo uses the Cash Money and LendDirect brand names to offer subprime open-ended loans out of 201 branches in eight provinces, and online in seven provinces.

- Canada POS lending. Flexiti is one of the largest POS lenders in Canada; it offers a somewhat different version of BNPL products offered by others.

- Card products.Revolve is a mobile-app-enabled virtual checking account with FDIC insurance. The company recently introduced First Phase, a subprime credit card.

Flexiti. Curo bought Flexiti last when it had $180 million in receivables, which grew to around $500 million by yearend. The product offers the consumer a “90 days same as cash” advance, and the consumer has the option after 90 days to turn the advance into a loan. Curo gets paid with a roughly 5% merchant discount, and interest income if the advance turns into a loan. Other POS competitors offer customers the “pay in four” equal installment options. When Curo bought Flexiti, 100% of Flexiti’s business was to prime customers, but it is now expanding slowly into subprime. The key to Flexiti’s future growth is largely tied to the success of its retailing partners, and the company’s most important relationship is with LFL, the largest home furnishing and electronics retailer in Canada. The rapid receivables growth last year at Flexiti, along with the upfront loss-reserving requirement, resulted in a large GAAP loss at the company last year. The company may get to breakeven this year before having a big GAAP net income year in 2023.

Heights Finance. The company operates 390 branches in eleven Southern and Midwestern states. Curo completed the acquisition of Heights in late December last year from a private equity firm that Gayhardt knows well. Heights is both a prime and subprime lender, with 60% of its loans at APRs under 36%. The average loan size is $3,700 and 28 months in duration. The larger loans Heights makes are to borrowers with credit scores of around 650, while the smaller loans are to borrowers with scores of 620. Last year, the company closed 30 branches and this year the company is planning to transition some of its branches from standalone facilities to offices located inside an office building. Loans are typically originated by the borrower calling a branch and asking what documents he needs to bring before going to the branch to complete the loan. The company plans to move into four new states this year.

First Phase card. The company is venturing into the challenger bank space with its Revolve checking account product, made possible through a partnership with Bank of Missouri. Using the same partnership, Curo has begun to offer First Phase credit cards, but Gayhardt emphasized that it will expand its customer base very slowly for the first 120 days, which is a great strategy in light of the rapidly changing credit quality of subprime consumers.

The Flexiti and Heights Finance acquisitions are the biggest steps Gayhardt has taken in the company’s transition from being highly dependent on the deep subprime U.S. consumer installment lending market. The company’s earnings stream has been significantly changed both geographically as well as with the credit profile of the average customer. This should bode well for its shareholders. (The investment partnership I manage is a shareholder of Curo.)

NEXT WEEK: On Tuesday, the National Federation of Business will release its Small Business Optimism Index for March. The consensus expectation is 95.0 vs 95.7 in February. Also on Tuesday, the Department of Labor will release the Consumer Prices Index for March. The consensus looks for a monthly change of +1.2% vs +0.8% in February. Then on Thursday we’ll get March Retail Sales. The consensus expects a monthly change of +0.6% vs +0.3% in February.

THE LAST WORD: I think it is a pretty safe bet that in my lifetime, the opening day of The Masters and Major League Baseball never took place on the same day, as they did yesterday. Tiger Woods not only played, but played well, less than 13 months after his serious injury. I am hoping that he is in contention on Sunday because that would be exciting for so many of us. In baseball, my Cubs played at home at Wrigley Field, where the temperatures were in the low 40s and the wind chill made it seem more like football weather. They won and now the oddsmakers expect them to win 74 more games and lose 87. (My approach is to look forward to all those wins.) Seeing the highlights of the game reminded me of playing high school baseball in Chicago. Often the first two weeks of the season, which were the last two in March, consisted of throwing and catching in the gym because either the weather was too bad or there was too much snow on the ground. My memory is that our first few games every year were either cancelled because of April showers or were played with snow drifts on the side of the field, and it was always bone-chilling cold. My point is that it is exciting that we have The Masters and MLB this weekend, but actually playing baseball outside in early April in some climates can be rough.

Copyright © 2022, Second Curve Capital LLC

Copyright notice: This publication is protected by copyright. It is a violation of federal law to reproduce or forward all or part of it to anyone. This includes photocopying, faxing, e-mail forwarding, and Web site posting. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.