Wouldn't this advice be helpful every Friday?

Sign up to receive Tom Brown's Exclusive Banking Weekly in your Inbox each Friday.

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

–Copyrighted Material; Do Not Forward, Photocopy, or Redistribute In Any Way–

Vol. VII, No. 47

TOM BROWN’S BANKING WEEKLY: 12/9/22

Financial Services Insights and Intelligence

FIRST WORD: What Jamie Dimon told me last week. It has become my habit, when I finish a meeting with the CEO of a large bank, to immediately find a spot to write down my high-level key takeaways. After my meeting with Jamie Dimon last week, I simply wrote down that I had just received a master class in how to properly manage a large-cap public company. I also wrote down that I wished more companies were managed the way Dimon runs JPMorgan Chase. Ironically, the companies I believe are most similarly managed that way are the founder-led banks like Bridgewater Bank, ConnectOne, Pinnacle Financial, ServisFirst, WinTrust, and many others I have written about. Dimon manages JPMorgan with a long-term, short-term balance, as if he owns 100% of the equity. It is both refreshing and admirable. Here are some details from our discussion.

Message to fellow bankers. I met with Dimon on the same day JPMorgan was hosting its annual CEO meeting, which I discovered when I overheard a conversation on the Acela train to New York. So my first question to him was what was his message going to be to the other bank CEOs. He said he was going to tell them that they should be proud to be bankers because they help everyone, including consumers, businesses, communities, and government agencies, achieve their goals and desires. It is noble work. He also said he was going to encourage the bankers to spend more time spreading the word to their Representatives in Washington about what they do to help others, because too many Congressmen don’t know, and view bankers as the bad guys. I can’t remember a single one of Dimon’s annual letters to shareholders where he did not mention the important and positive role banks play in our society. It is not just words to him; he is passionate about the nobility of banking done right.

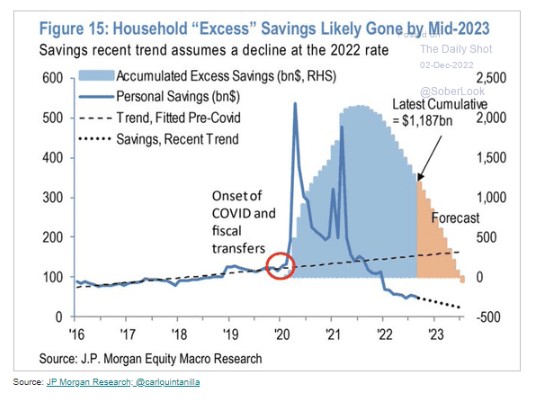

The U.S. economic outlook. This past summer, Dimon said the U.S. economy might experience a hurricane some time in coming quarters. What he told me is the U.S. economy is currently healthy thanks to strong consumer spending, which is running 10% higher than last year and is up 40% from pre-pandemic levels. Consumer spending is not being constrained by falling real incomes, as has occurred in the past, because consumers are raiding the excess savings they built up at the beginning of the pandemic. JPMorgan’s economic research suggests the excess savings will run out around the middle of next year.

Dimon’s point about the future of the economy is that the range of possible outcomes is “unprecedented” due to all the distortions to economic activity since 2008 and all the geopolitical uncertainties. When I asked if his message was that JPMorgan is ready to handle any possible economic scenario, he surprised me when he said, “No. My message is JPMorgan is prepared to manage through any economic environment and serve our clients.”

Dimon’s point about the future of the economy is that the range of possible outcomes is “unprecedented” due to all the distortions to economic activity since 2008 and all the geopolitical uncertainties. When I asked if his message was that JPMorgan is ready to handle any possible economic scenario, he surprised me when he said, “No. My message is JPMorgan is prepared to manage through any economic environment and serve our clients.”

He went on to tell me a story about when the price of oil went from $120 per barrel to $30, and the regulators downgraded the bank’s energy reserve-based loans more severely, and told the bank not to extend any more credit to those energy borrowers. Dimon said the bank wasn’t going to abandon its clients in a time of need. He said he just got back from meeting 100 bank clients in Houston, and couldn’t imagine that meeting even happening if the bank had stopped lending in the face of low oil prices as the regulators had suggested. “I’d rather lose $200 million to $300 million taking care of clients.”

Investment spending. On the company’s last two earnings calls, bank analyst Mike Mayo has asked Dimon some version of this question: “You talk about the potential for a nasty recession, yet your investment spending remains high and you continue to build the company’s headcount. Why aren’t your actions consistent with your comments?” Essentially what Dimon told me was he doesn’t change the company’s long-term management approach based on a near-term economic forecast. Dimon even wrote in his letter this year that the company was raising its investment spending from $11.5 billion in 2021 to $15 billion this year. “We have always believed that investing continuously and rigorously for the future is critical for our ongoing success,” he wrote. Dimon believes it is harmful to the hiring process or the de novo branch-opening process to turn the spigot on and off. As for marketing spending, Dimon had an interesting take on spending in uncertain economic times: “Marketing spend may be more valuable in a downturn.” Dimon reiterated a point he has made to me before that all investment spending goes through rigorous ROI analysis, but he reiterated that some investments, like digital account-opening, are made simply because they are viewed as table stakes.

Fintech investment opportunities. I asked Dimon if he thought there would be opportunities to acquire either private equity-backed or publicly traded fintechs, given their lower valuations, and he said, “We already have.” The company has made both whole-company acquisitions as well as investments in hundreds of fintechs. He believes some fintechs will experience cash flow problems in the first half of next year, which should give JPMorgan some new investment opportunities.

Regulatory environment. I was interested to hear if Dimon felt the regulatory environment had changed under the Biden administration. I was surprised at his level of disappointment in some of the people that have regulatory roles. I asked if he felt there were too many with only academic experience and not real-world practical experience, and he agreed. Dimon, a lifelong Democrat, expressed disappointment with the president and the disconnect between the president’s kind words about business and the anti-business actions of the administration. He is disappointed that the bank regulatory agencies not only don’t work together, but even sometimes work at cross purposes. He is disappointed that the regulators and politicians can’t see that some of their actions hurt the very people they are trying to help the most.

Another disappointment is that when some politicians find a problem in the banking industry, their first reaction is to devise a broad, overreaching solution. Dimon gave the example of fraud in Zelle payments. He said there are areas where the banks could and will make some improvements, but some Senators are offering legislation that would overly stifle a popular and cost-effective consumer service. Part of the problem with Zelle is that not all the hundreds of banks offering the service are as good at fraud monitoring as the large banks that own Early Warning Services, Zelle’s parent. Dimon wanted to make the point that he is not complaining about the regulatory environment, just trying to express his view of how it could be improved. He said no one at JPMorgan can say that some regulation or agency got in the way of JPMorgan serving any of its clients.

The ever-rising capital standards. I believe that current bank capital standards, particularly for the largest banks like JPMorgan, are a mess, resulting in these companies being severely overcapitalized. Even worse, the standards keep being raised, and regulators are still working on another revision to them, Basel IV. Suffice it to say that Dimon is in strong agreement about banks being overcapitalized, and has frequently written in his annual letters to shareholders about his issues. Let’s start with the annual stress test, CCAR. Dimon has long been a fan of stress-testing, and JPMorgan has done over 100 weekly stress tests for as long as I can remember. However, he believes the Fed’s annual stress test has become disconnected from reality. The Fed does one stress test, and doesn’t allow for the assumption of logical steps bank managements would make in a stressed environment. One example is the maintenance of the current dividend in the face of falling capital levels. Dimon said he offered to legally commit to eliminating the company’s dividend if its CET 1 capital ratio fell below 10%, not 4% as is required, but the Fed said “no” and continues to assume JPMorgan would maintain its current dividend in the face of shrinking capital.

Another of Dimon’s objections to capital regulation relates to the G-SIB requirement, which applies to only the largest U.S. banks. Dimon wrote in his letter this year that “the U.S. implementation of G-SIB requirements does not enable a level playing field—plain and simple. Not only have American rules made the G-SIB designation worse for American banks, but the rules have not been adjusted as the framework allows.” He estimates the G-SIB requirement requires JPMorgan to maintain two percent more capital than foreign banks.

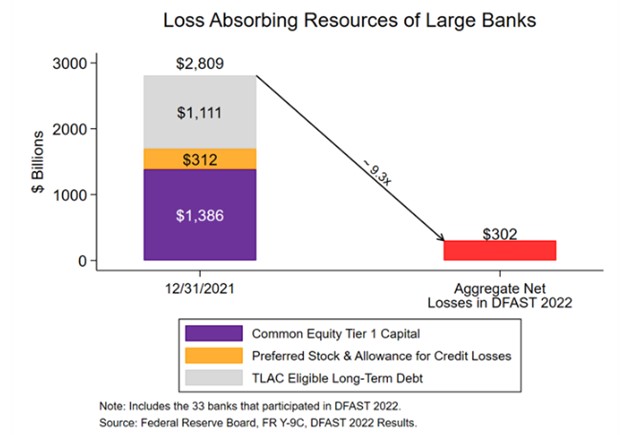

Dimon ended our capital discussion by giving me a white paper by the Bank Policy Institute dated November 10, 2022 with the title “It’s Time for a Reality-Based Assessment of Current Capital Levels.” It included this quite telling chart.

The conclusion is that large U.S. banks are currently significantly overcapitalized and that capital standards are going higher for no other reason than the mis-guided belief that “more is better.” Why don’t more large-bank CEOs publicly discuss capital standards? Perhaps the biggest fear is that if they do, they will be “Wells Fargoed” with punitive regulatory actions.

The long term. Jamie Dimon runs the biggest banking company in the U.S. with a long-term, do-what’s-best-for-the-client management style similar to how a founder-CEO of a $3 billion bank runs things. There are many other bank CEOs that I think do a great job, but the way in which Dimon operates as a great CEO is unique to him.

SAVVY: Oh brother. We live in a world where Taylor Swift apparently did a better job sizing up FTX than Sequoia and BlackRock did.

WORDLE’S FIFTEEN MINUTES OF FAME: The most-searched word on Google this year is “wordle.” Amy plays it religiously every night before she goes to sleep. I sense a passing fad.

THEY NEVER SLEEP: Ugh. Another high-priced investment fad sweeps Wall Street:

BUILD-YOUR-INDEX BOOM COULD

HIT $825 BILLION IN FOUR YEARSAn index strategy that’s all about customization is expected to grow faster than other investment vehicles over the next four years as investors’ desire for personalization intensifies.

Cerulli Associates expects assets in so-called direct indexing to climb to $825 billion by 2026 from roughly $462 billion now, according to the research shop’s new paper sponsored by direct-indexing provider Parametric Portfolio Associates. That’s a five-year compound annual growth rate of 12.3%, exceeding growth forecasts for exchange-traded funds, mutual funds and separately managed accounts.

Direct indexing essentially allows investors to cherry-pick which stocks to buy in a benchmark index instead of owning a fund that tracks a specific gauge like the S&P 500. In recent years, the strategy has boomed in popularity. . . . [Emphasis added.]

Such cutting-edge innovation! How this is any different from building an equity portfolio the old-fashioned, stock-by-stock way—except that the direct-indexers will charge you around 40 basis points per year—isn’t immediately clear to me. Anyway, what a scam.

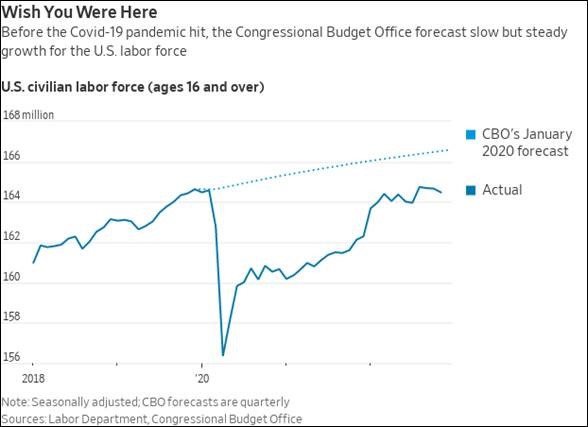

STILL SEARCHING FOR THE MISSING WORKERS: At the start of the pandemic, the labor force suffered a big decline, and has been gradually rising to its pre-pandemic level. But the labor force is still well below what was expected, and no one seems quite sure why.

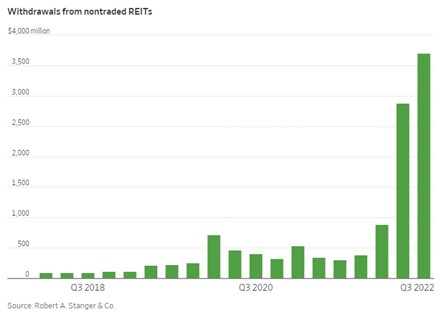

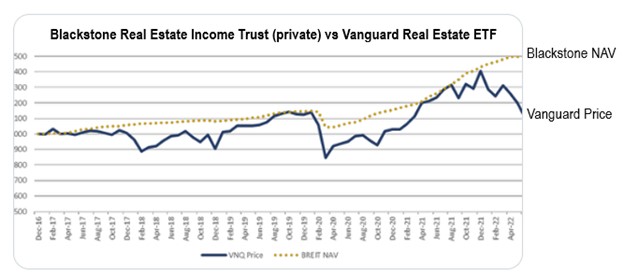

EXITS BLOCKED: Hoo boy. It’s not just Blackstone. Add Starwood Capital, BlackRock, and CBRE Investment Management to the list of real estate investors that are limiting the amount of money that investors can pull from their funds.

Oh, and as Blackstone and the rest move to sell properties to raise the cash they need to fund those redemptions, their investors could be in for a rude surprise:

THE OFFICE VACANCY PROBLEM IN THE TWIN CITIES: Along that same line, two large office buildings in the Twin Cities, LaSalle Plaza and Fifth Street Towers, are facing likely foreclosure. Cushman & Wakefield estimates that the office vacancy rate in the Twin Cities is 25%. Not only is this a problem for lenders, but commercial properties account for around 30% of the property taxes collected in Minneapolis. The city began lowering tax valuations for downtown office towers in 2020, which has started shifting the tax burden to residential property owners. Stay tuned, this story is just beginning.

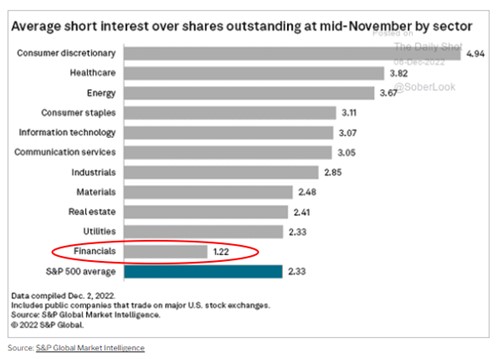

NOT SO UNLOVED: This kind of surprises me, to tell you the truth. The financials are currently the least-shorted of the S&P 500’s eleven industry sectors.

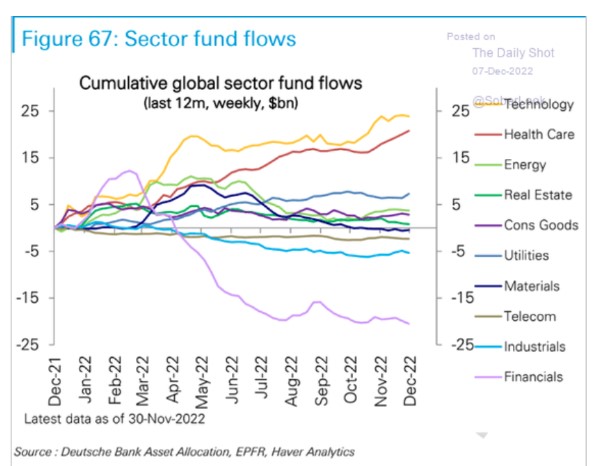

2023 WILL NOT BE LIKE 2008: The vast majority of investors and CEOs expect a recession to happen next year, with many fearing it will have the same impact on banks as the one in 2008. As a result, investor fund flows out of financials have been significant on a global basis.

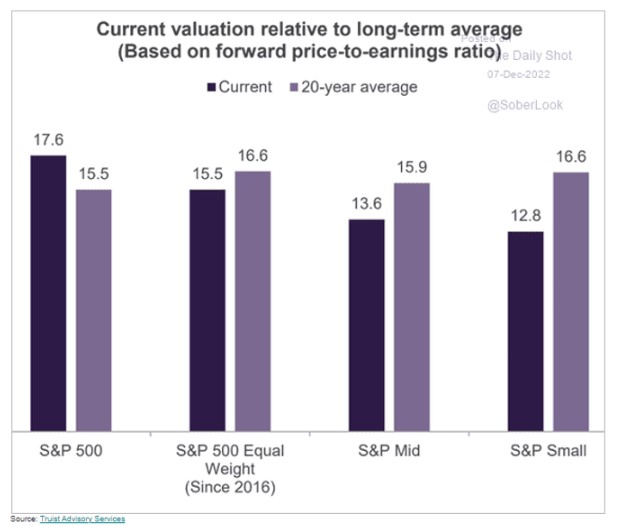

SMALL CAPS OFFER THE BEST VALUE: Despite the market’s decline this year, the S&P 500’s P/E multiple remains above its 20-year average, largely because of the impact of large tech company components. The sector of the market where P/E multiples are the most below their long-term average is the small-cap sector. This is true in the banking sector, where a number of high-performing banks trade for less than eight times next year’s estimated earnings.

EVERGREEN: Of course he does.

THE TRENDS AT DOLLAR GENERAL ARE LEADING ECONOMIC INDICATORS: In July, I gave a presentation to the board of KeyCorp., and had a chance to talk with Todd Vasos, who was a board member and the CEO at the time of Dollar General. I was fascinated by what the trends in sales at Dollar General tells us about the condition of the non-urban working class. Vasos retired on November 1 and was replaced by Jeff Owen. Last week, Dollar General announced it planned to open 1,050 new stores in 2023. The company already has the most locations of any retailer in the U.S., with over 10,000. According to GlobalData, six in ten lower-income consumers are shopping closer to home to save on gas. Dollar General is expanding into fresh produce, with 3,000 stores currently offering produce and more to come. Hello, Wal-Mart.

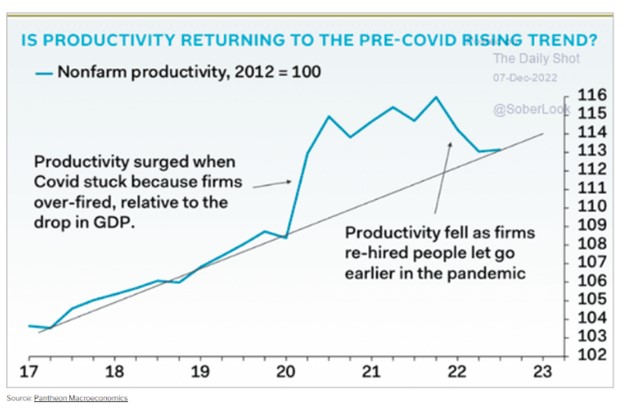

U.S. PRODUCTIVITY HAS RETURNED TO TREND LINE: With new hybrid work rules, it will be interesting to see where productivity measures go over the next two years. Given how fast it surged and then returned to trend line, I say it goes lower.

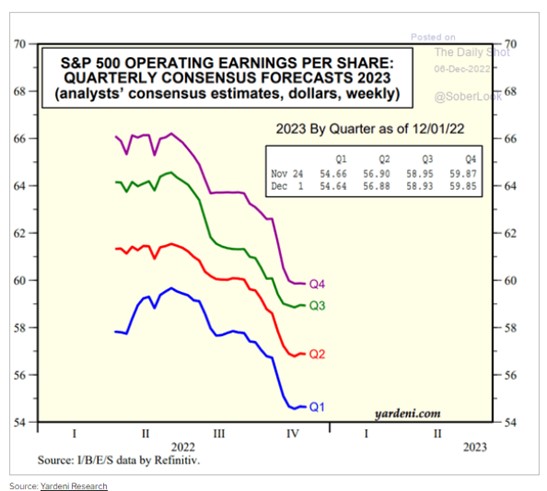

LEVELING OFF: Well, good. Consensus earnings estimates for next year have stopped going down.

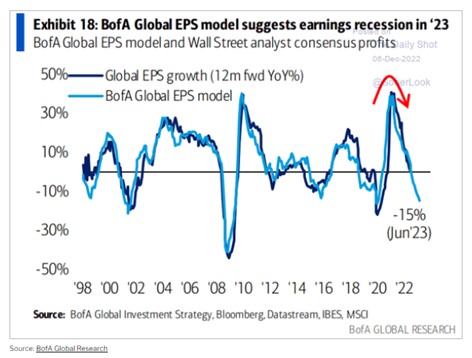

READY TO SINK: Then again, Bank of America’s global earnings model—and please don’t ask me how it’s calculated—points to a pretty substantial earnings decline in 2023.

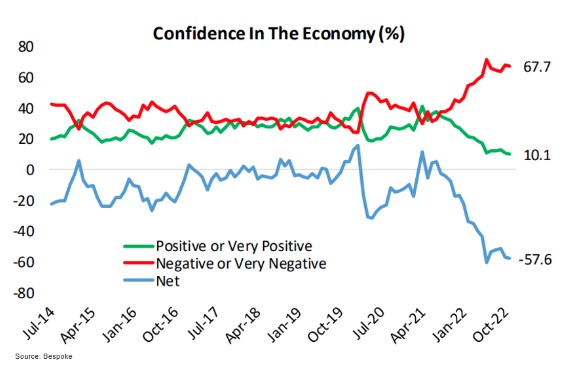

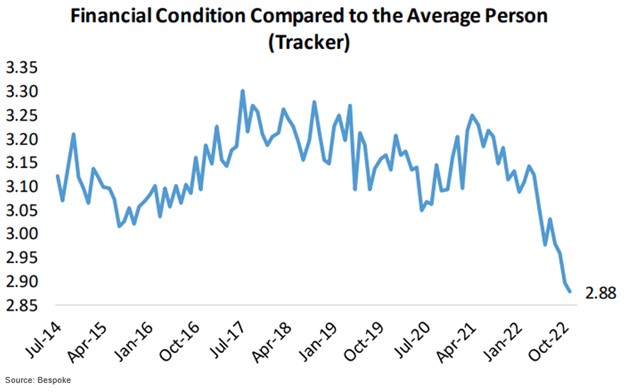

OUR DISMAL MOOD: U.S. real GDP grew at a 2.6% pace in the third quarter, and the Atlanta Fed predicts it is growing at over a 3% rate in the current quarter, yet individual Americans are exceptionally pessimistic about the economy.

In addition, Americans believe their position is worse than the average person’s by a record margin.

ALL CLEAR: At the risk of sounding insufficiently resolute on the inflation question, I have to admit that former Western Asset Management chief economist Scott Grannis’s argument that the problem has already basically solved itself, and that the Fed can start cutting interest rates sooner rather than later, makes a lot of sense.

[A] key difference this time around is that the bout of inflation we have suffered was not the result of Fed policy (it usually is). It was the result of a massive surge in Covid “stimulus” payments which put trillions of dollars into the hands of people who were still hunkered down and unable to spend it. . . . Once the Covid scare passed, the liquidity dam broke and a tsunami of price increases spread throughout the economy.

So it wasn’t low interest rates that caused the problem, it was too much government spending. Higher interest rates came to the rescue, giving people and incentive to hold on to their extra cash . . . Now, interest rates can decline and help the economy get back on a normal track fairly easily. . . . Meanwhile, M2 is declining, which means that excess cash is being reduced with the passage of time. [Emphasis added.]

Also, early rate cuts might ease the ongoing decline in the housing market, which would be nice.

SOLID ADVICE: Um, OK. I’ll try to remember.

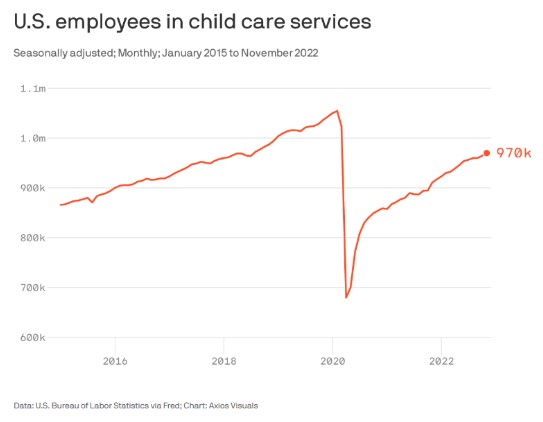

CHILD CARE COMING BACK SLOWLY: One of the causes of the decline in the labor participation rate is the lack of child care for parents who would like to be working outside the home. The number of child care workers is still about 9% below the pre-pandemic level.

GLOOM-AND-DOOM-FEST: I won’t lie. The contrarian in me loves to see stories like this:

WALL STREET CHORUS GROWS LOUDER

WARNING THAT 2023 WILL BE UGLYIn the Federal Reserve’s quiet period before its officials meet to decide their final actions this year, Wall Street watchers are filling the void, loudly warning that next year’s outlook for the U.S. economy and stocks is grim.

From Goldman Sachs Group Inc.’s David Solomon caution that the economy faces “bumpy times ahead,” to JPMorgan Chase & Co.’s Jamie Dimon grimmer view that this would be a “mild to hard recession,” to Morgan Stanley Wealth Management’s Lisa Shalett, who told Bloomberg Television that corporations are facing a “rude awakening” on earnings, the messages have become increasingly dire.

“We do not think the economic conditions for a sustained upturn are yet in place,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note. “Growth is slowing and central banks are still raising rates.” [Emphasis added.]

Scary, no? It’s enough to make you wonder why the recession hasn’t started already. Anyway, it seems a safe bet that, from here, any surprises can only be positive.

DOUR: Oh, and then there’s this:

![]()

GETTING MOVING: And so the pushback by employers continues. Snap is the latest company to insist that its workers return to the office.

SOME NERVE: Um, the reading on the chutzpah meter here really is off the charts.

Oh, and while I’m on the topic of the SPAC king, this was on Monday:

NOTABLE RELEASES NEXT WEEK: On Tuesday, the National Federation of Independent Business will release its Small-Business Optimism Index for November. The consensus expects 90.7 vs 91.3 in October. Also on Tuesday, we’ll get the November Consumer Price Index. The consensus looks for a monthly change of +0.3% vs +0.4% in October.

THE LAST WORD: A tale of two cities. Last week, Amy and I went up to Manhattan on Wednesday before my meeting with Jamie Dimon the next day. We took the Acela train from Philadelphia to New York and then the subway up to our hotel. Amy wasn’t particularly thrilled about taking the subway, given the stories of subway crimes being reported, but it is really the only way, other than walking, to move around Manhattan, and that’s doubly true around the holidays. I worked in Manhattan for over 30 years and was a frequent subway rider, but my experience this time was much different. There was a huge increase in police presence on the train platforms. In addition, when walking to dinner or to JPMorgan’s headquarters, there were police seemingly on every corner to control traffic and prevent gridlock. I was really impressed. Maybe New York’s new mayor, Eric Adams, is turning things around in the city.

In contrast was my experience a couple days later in Philadelphia. Amy drove her friend, Lea Perretta, into the city to attend a wedding ceremony in the afternoon for the son of another close friend, Carol Higgins. Since there was going to be a few hours’ gap between the wedding ceremony and the reception, Lea’s husband, Anthony, offered to drive both of us to the reception. He picked me up at 5:15 for what should have been a 30 or 40 minute drive. The highway part was a breeze, even with constant rain, and we exited the highway after just 20 minutes. From there, it took us another 55 minutes to go less than two miles. I have never been in such gridlock. We spent four turns of a traffic light without moving in the middle of one intersection. Not a single cop was seen along the way, in contrast to what I experienced in Manhattan. Anthony and I missed the entire cocktail hour and walked in just as the bridal party was being introduced. I felt sorry for Anthony, who had to handle the driving, but frankly, I had a great time getting to know him much better. When the bride and the groom came around to our table, the groom, Bill Higgins, proudly told me he is a regular reader of this weekly. Congratulations to Andrea and Bill Higgins, whose reception was much fun and went off like clockwork, but the city of Philadelphia needs to get its act together.

Copyright © 2022, Second Curve Capital LLC

Copyright notice: This publication is protected by copyright. It is a violation of federal law to reproduce or forward all or part of it to anyone. This includes photocopying, faxing, e-mail forwarding, and Web site posting. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.