Wouldn't this advice be helpful every Friday?

Sign up to receive Tom Brown's Exclusive Banking Weekly in your Inbox each Friday.

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

–Copyrighted Material; Do Not Forward, Photocopy, or Redistribute In Any Way–

Vol. VII, No. 16

TOM BROWN’S BANKING WEEKLY: 4/29/22

Financial Services Insights and Intelligence

FIRST WORD: An update on Regions Financial. Regions was one of the companies most hurt by the recession of 2008 and the associated credit problems. The company named Grayson Hall as its chief operating officer in 2009 to lead its recovery, and he became CEO in 2010. Hall did a terrific job with the turnaround, and then turned the CEO job over to John Turner in mid-2018. In 2012, once the credit situation was stabilized, Hall and Turner looked at the company’s pre-recession returns, which were in the bottom quartile, and developed a plan to lift returns to the top quartile by de-risking the company’s loan portfolio, exiting some businesses, and improving others, most notably retail banking. Regions has achieved top-quartile performance status now, but this improvement has yet to be reflected in its stock valuation. I spoke with Turner and CFO David Turner (no relation) yesterday for a strategic update.

Top priorities. Turner is all about execution these days rather than dramatic change or large transformative acquisitions. He said he is focused on five things: growing customer relationships, ensuring “sound” growth, achieving continuous productivity improvement leading to a lower efficiency ratio, maintaining a top-quartile return on tangible common equity, and generating sustainable earnings per share growth. Large bank acquisitions have not been on Turner’s radar since he became CEO, but he has made some skills-focused acquisitions, including three that were completed in the fourth quarter of last year.

“Surge” deposits. Regions’ core deposit franchise is unquestionably its crown jewel and should serve it well in the current rising-rate environment. David Turner has provided an interesting analysis of how he thinks the company’s deposit beta will behave in this cycle versus the last upcycle. For the legacy deposit base, he believes it will be similar, but he separates into three buckets the $40 billion of what he calls “surge” deposits that were largely generated by the government’s actions taken during the pandemic. The first is $14 billion that he believes will have a beta in line with the legacy deposits of around 10% to 20% for the first 150-basis-point increase in the fed funds rate. The second bucket is $12 billion where the company is expecting a beta of 40% to 60%. Finally, there is $14 billion that will have a beta of 80% to 100% if Regions elects to try to retain all these deposits. The company expects its margin to rise to the 3.75% level if the fed funds rate goes to 2.5% and then it will try to lock that level through hedges. The company has already added $4.7 billion in forward-starting swaps that begin in 2024 to protect the margin from falling rates. This provides protection in the future without reducing its positive sensitivity to higher rates in the short term.

NSF and OD fees. Historically, Regions has had an above-average level of service charges because of its mass-market retail customer base. The company has made changes which will reduce the level of such fees in the future.

Commercial banking strategy. As part of its strategic shift to lift the company’s financial performance, in 2014 the company began to build out its capital markets capabilities through staffing additions and acquisitions. Last year, the company acquired Clearsight Advisors which has niche-focused M&A expertise. Turner is interested in more such skills-based acquisitions.

Small-business banking strategy. Regions has a three-pronged strategy to expand its small-business banking business. First, it was not much of an SBA lender before the PPP program, but as a result of the experience gained, Turner has decided to expand the company’s ongoing effort. Second, the company is expanding its non-restaurant franchise banking activities. Finally, the company acquired Ascentium, a small-business equipment finance company a few years ago and is encouraged by its growth prospects.

Branch network changes. Like all large banks, Regions has been changing its distribution network by reducing the number of branches in legacy markets, adding branches in markets that are completely new, such as Houston, or where it already operated but with a limited branch network (Atlanta, Orlando, and St. Louis). Of these four markets, the one that is showing the strongest growth is Atlanta, which makes sense since it is so close to the company’s Birmingham, Ala. headquarters. Over the last year, Regions has reduced it branch network by a net 500 locations, or 25%.

Opportunities from the mergers of others. The advantage of not doing a large bank merger while others in your footprint are focused on integration is that Regions can, and has, picked up talent from the consolidators. This continues.

Core system conversion plan. Regions’ core system provider will no longer support the software beyond 2028, so Regions began to evaluate new core systems providers over a year ago. Turner is convinced that the process can result in an improved customer experience in each of its business lines, but wants to keep the company’s total tech expenditures in the 10% to 11% of revenues range during the conversion. A decision on a new core provider will be made this year, and then the headaches for Turner will intensify.

The transformations of Regions and KeyCorp since the 2008 recession share many similarities, as does the lack of investor recognition of the progress both companies have made at reducing their loan portfolio risk and raising their sustainable level of profitability.

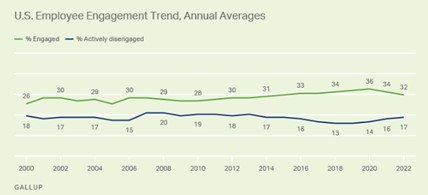

NOT SO HAPPY: And here I’d been assured that widespread working from home is making employees happier and more productive in their jobs. Maybe not! The percentage of workers who tell Gallup they’re actively engaged in their work is at a seven-year low.

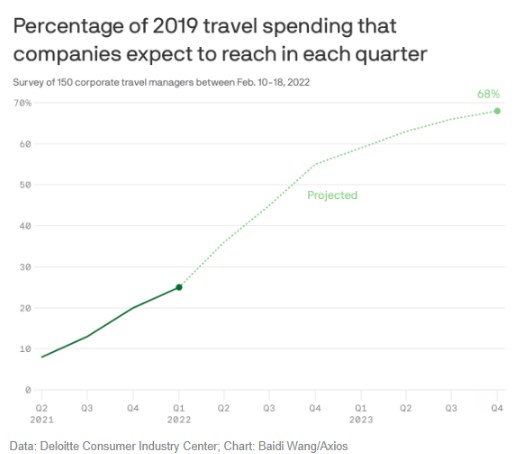

SLOW RECOCERY FOR BUSINESS TRAVEL: While leisure travel has returned with a vengeance, business travel is still only 25% of its pre-pandemic level, according to Deloitte‘s annual survey of corporate travel managers.

LOONY: In anticipation of the Berkshire Hathaway annual meeting this weekend, let me take this opportunity to venture the opinion that the pending proposal to split Warren Buffett’s role as both chairman and CEO is one of the dumbest ideas I’ve heard in a while.

TRAINWRECK WATCH: Ah, the wonders of investing using other people’s money! This sure should be interesting to watch:

RISING RATES THREATEN COMPANIES

ACQUIRED IN LBO BOOMLow-rated U.S. companies borrowed record amounts in the loan market last year, highlighting the surge in floating-rate debt as interest rates are expected to rise significantly.

An economywide crunch is hitting everything from mortgages to commodities prices as the Federal Reserve tightens monetary policy in an attempt to tame inflation. Interest expenses on floating-rate loans rise with interest rates, making them attractive to debt investors as an alternative to bonds . . .

Companies with heavier debt loads can find themselves running short on cash if their interest rates climb alongside wages and other operating expenses. . . . [Emphasis added.]

I bet a lot of these deals were put together on the assumption that interest rates would never, ever rise again. Surprise!

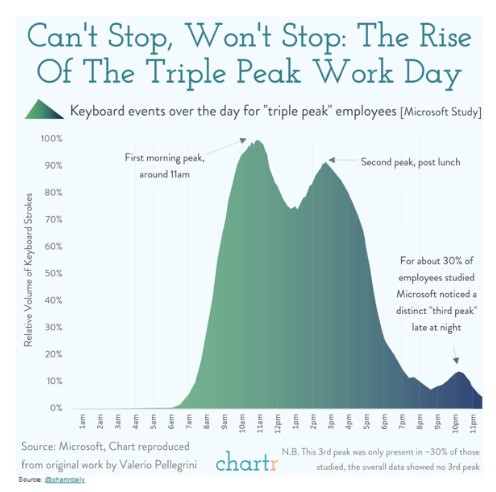

THE TRIPLE PEAK WORKDAY: Here’s an advantage to working from home that I bet employers didn’t expect: some workers are still at it well into the night.

GETTING REWARDED: The Great Resignation really is a thing. A relative of mine recently went to quit her job at a large Silicon Valley tech firm because she wanted to be paid more and not live in the Bay area anymore. The company doubled her salary, and now she can work from anywhere. Nearly 27% of economists surveyed by the Wall Street Journal this month said wage growth pressure is the biggest inflation risk this year, ranking just behind commodity price pressure.

ZIGGING AND ZAGGING: It’s nice to see that the people at the Fed are making progress in getting their policy message in sync. Yahoo Finance, last Thursday:

CNBC.com, the next day:

Helpful!

TWO SENATORS BARKING UP THE WRONG TREE: Elizabeth Warren and Bob Menendez claim that 18 million people in the U.S. were swindled in 2020 via fraudulent Zelle transactions. I don’t buy it. First off, in the vast majority of cases, the Zelle users authorized the transactions. If the senators want to make Zelle’s parent, Early Warning Services, responsible for non-fraud “fraud” losses, shouldn’t they also favor making banks responsible for customers’ lost cash? (Actually, I shouldn’t give them any ideas.) Last year, Americans sent $490 billion via Zelle. In my opinion, the senators should be applauding the consortium of banks who set Zelle up as a faster, no-fee alternative to Venmo.

CAN’T GET ANY BETTER: A possible sign that the economic cycle could be peaking? Maybe! The Wall Street Journal reports that Elkhart, Ind., the world capital of RV manufacturing, perhaps the most cyclical business on the planet, is now the hottest job market in the country.

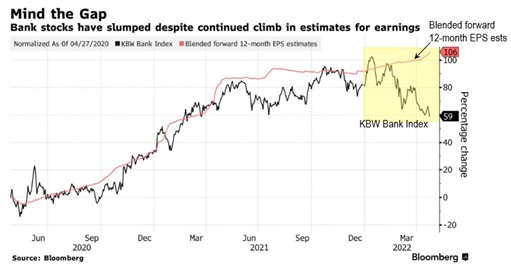

UP AND DOWN: Ah, the joys of being a bank investor. Even as earnings estimates for the group have surged in the wake of solid first-quarter earnings announcements, the stocks are on track for their worst month in two years.

The stock market isn’t supposed to work this way, is all I’m saying.

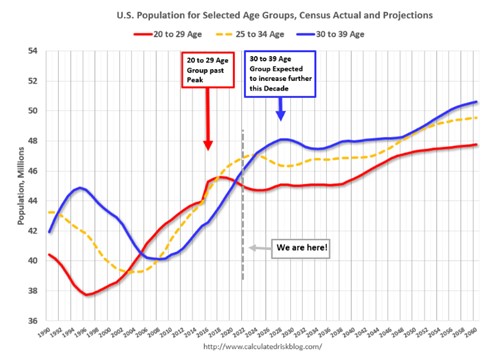

INCREASING DEMAND: This has to be a meaningful long-term tailwind for the housing market, right? Among prospective home buyers, the move-up-buyer demographic (that is, 30-to-39-year-olds) is growing fast and will soon be the largest by far.

AN UNMENTIONED CAUSE OF THE LABOR SHORTAGE: SUBSTANCE ABUSE: This is awfully discouraging. Between 9% and 26% of the decline in workforce participation between February of 2020 and January of 2022 among people aged 25 to 34 is due to an increase in substance dependence, the Bureau of National Economic Research reports.

NO SURPRISE: Is there no end to the number of valuable services Wall Street provides investors? Researchers at the London Business School estimate that retail investors have lost $5 billion, including $4 billion in transaction fees, trading options during the pandemic.

If you asked me to explain why broker-dealers should even be allowed to offer options trading to individuals in the first place, I’d have trouble coming up with a reason.

AN UNUSUAL EARNINGS SEASON IN A MOST UNUSUAL YEAR: By my calculations, I am now in the midst of my 164th quarterly earnings reporting periods. Here are some random observations from this one.

Terrible stock performance. When the year began, bank stock valuations were at an unusually wide, 60%, discount to the market average despite a favorable earnings outlook. If you had told me back in January that the long-term Treasury yield would rise to 3% by the end of April and that banks would report better-than-expected first-quarter earnings, I would never have thought that bank stocks would underperform the market in the first four months. But they have. The KBW Bank Index is down 24% from its January peak while the S&P 500 is down 12%. Given the more favorable earnings outlook because of the expected increases in the fed funds rate over the next year, I am looking for a strong recovery in bank stock prices before yearend.

Playing the guidance game. More bank managements are giving some level of line-item guidance and then they have to answer questions from analysts who want even more specific guidance. I don’t believe managements should even give quarterly or annual line-item guidance. The world is too complicated and the future is unknowable. When companies do give line-item guidance, their quarterly earnings calls deteriorate into earnings-model maintenance calls for analysts. Rather, companies should work harder at turning their calls into strategic line-of-business update calls. If you feel compelled to give guidance such as “We expect the margin to be up during the remainder of the year,” then you better be prepared to answer the follow-on question, “How much?” As an analyst, I like to know what management is thinking about the earnings outlook, but I recognize that they are making some assumptions that I am in just as good as a position to make as they are.

There were more bold predictions than I can remember. Comerica said on its call that if the fed funds rate is running 2.25% to 2.50% by the end of the year, it would experience a 23% increase in its net interest income in the fourth quarter compared with the prior year. Regions made a similar projection, saying that net interest income in the fourth quarter would be 15% higher than the first quarter if the forward curve plays out as it is currently expected.

Some interesting new disclosures. Bankers have always talked about period-end figures and average figures, but Veritex is the first bank that I know that has provided a chart of the loan outstanding progression throughout the quarter to highlight its strong growth toward the end of the quarter. I encourage banks to deviate from their usual quarterly packages and include helpful new disclosures when appropriate.

Why don’t analysts pay closer attention. It seems to me that analysts ask more questions on issues that management already talked about in their prepared remarks. I listened to one call this week where the CFO said he expected the net interest margin to be up nine to eleven basis points in the second quarter versus the first, yet one of the first few questions asked was about how much the margin would be up in the current quarter.

Hits to tangible book value because of changes in AOCI. Neither the regulators nor the rating agencies say they care about changes to tangible book value because of changes to AOCI brought about because of changes in interest rates, so why does it matter to some analysts? In the first quarter, some banks saw a 20% reduction in their TBV because of changes to AOCI, but this resulted from the marking of just one aspect of the balance sheet to market, not the entire balance sheet, most notably the value of deposits.

The prepared remarks are often too long. It shouldn’t take a $10 billion regional bank 40 minutes of prepared remarks to explain its quarterly earnings. If this were 40 minutes of a strategic review, I could understand, but it’s generally 40 minutes of numbers reading. Managements should tighten up their calls. Capital One and United Community Banks generally finish the prepared comments from their CEOs and CFOs in less than 20 minutes. Other banks should figure out how to do the same.

“Thanks for taking my question” has replaced “Congratulations on a great quarter guys” as the most overused line by analysts. I find both to be annoying, but am glad I am hearing less “great quarter” comments.

My first earnings season consisted of watching the Dow Jones tape for information. A couple years later it was centered around acquiring a fax of the earnings press release. The next evolution was receiving an email of the press release, leading to the current practice which consists of an email of the earnings press release, an email containing a PowerPoint presentation, and a conference call. In my opinion, the current system is not the most efficient for managements, analysts, and investors. I don’t have another 164 earnings seasons to go through; I am hoping some company will reinvent the process soon, and others will follow.

NO EASY FIX: Speaking at the Auto Finance Risk Summit in San Diego this week, Kevin Charter from Manheim Consulting gave this warning, and cited the expected continued decline in the number of vehicles coming off-lease as a somewhat overlooked constraint on used-car supply.

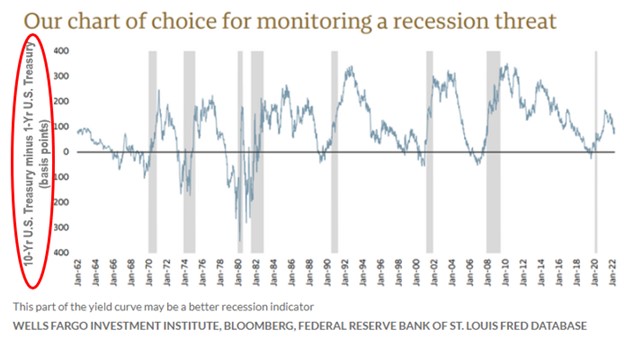

STILL WRONG: Ugh. People seem to be having trouble figuring which yield curve, when inverted, signals that a recession could be looming—and sure it ain’t this one:

A reminder: an inverted yield curve can be a harbinger of a recession because it’s a sign that bank lending has become unprofitable and so credit creation is set to slow. The near-term rate to pay attention to, therefore, is one that closely approximates a bank’s funding costs—the rate on the three-month T-bill, say, or the fed funds rate. Sorry to sound so pedantic.

HEADING SOUTH: The Philadelphia Fed’s Manufacturing Survey seems to be hinting that corporate earnings are about to decline.

BACKWARDS: The hogwash from investment gurus, it never stops! Here’s RTM Capital Advisors’ chief investment officer Mark Ritchie, II on MarketWatch on Tuesday:

When the market is grappling with too many things at one time, it’s generally a headwind, meaning the more managers have to discount too many issues, the more they have to lighten up on risk. [Emphasis added.]

One hundred percent wrong! When investors are “grappling with too many things at one time”—whether right now happens to be one of those times is another question, by the way—is when stocks are most attractive. The wall of worry, remember? It’s when investors aren’t grappling with anything at all that’s the time to look out.

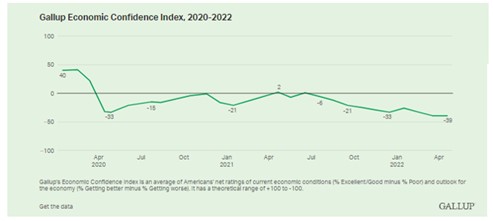

DOWN IN THE DUMPS: The nation’s mood seems to be souring in a hurry. Gallup’s Economic Confidence Index is now lower than it’s been in years.

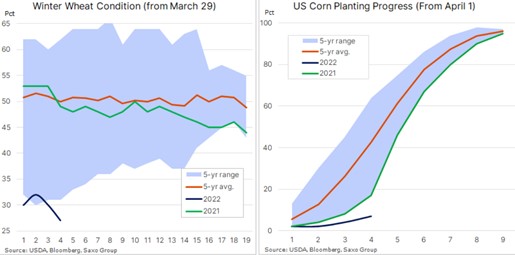

TOO LATE: Another inflationary straw in the wind: The spring planting season doesn’t seem to be going so well.

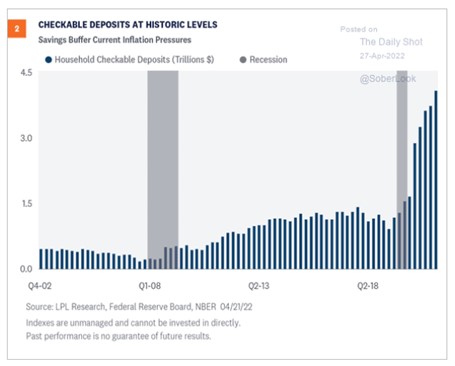

PENT UP: Oh, and there’s this: a lot of that cash the government has been sending consumers over the past few years still has yet to be spent.

NEXT WEEK: On Monday, we’ll get the April ISM Manufacturing Index. The consensus expectation is 57.8 vs 57.1 in March. Then on Wednesday, the April ISM Services Index will come out. The consensus looks for 58.7 vs 58.3 in March. Finally, on Friday, the Labor Department will release the April Employment Report. The consensus expects a change in nonfarm payrolls of +390,000 vs +431,000 in March, and an unemployment rate of 3.6% vs 3.6%.

THE LAST WORD: My commute to the office has been a dream since I moved the company from Manhattan to Radnor, Pa. four years ago. It is less than three miles and takes me just six minutes driving my own car. Prior to the move to Radnor, my commute for 35 years was generally 90 minutes one way and involved a car, train, subway or cab, and short walk. My point is that my commute is really short and easy compared to what it used to be. Yet I am amazed at how often I encounter a crazy commuter driving to or from work. My three miles include residential streets with a 25-mile-per-hour speed limit and larger roads where the speed limit is 35 m.p.h., but there are some commuters who seem to believe those roads become the autobahn during commuting hours. They apparently don’t care that people use the same streets to walk their children or their dogs. In addition, some of these commuters feel that during commuting hours they can make their own traffic rules, such as adding a second left turn lane. In just six minutes each way, I see some crazy stuff and I assume these are otherwise nice, law-abiding neighbors who go temporarily insane by virtue of commuting. The ultimate irony is that right in the middle of my six-minute commute sits the Radnor police headquarters, yet I have never seen anyone stopped during commuting hours. Hmm, do you think this town has unspoken crazy commuter rules that no one has ever told me?

Copyright © 2022, Second Curve Capital LLC

Copyright notice: This publication is protected by copyright. It is a violation of federal law to reproduce or forward all or part of it to anyone. This includes photocopying, faxing, e-mail forwarding, and Web site posting. The Copyright Act imposes liability of up to $150,000 per issue for infringement.

Printed by:

Copyright 2018, Second Curve Capital, LLC. Copyright notice: It is a violation of federal law to reproduce this newsletter in any way, including via photocopying and email forwarding. The Copyright Act imposes liability of up to $150,000 per issue for infringement.